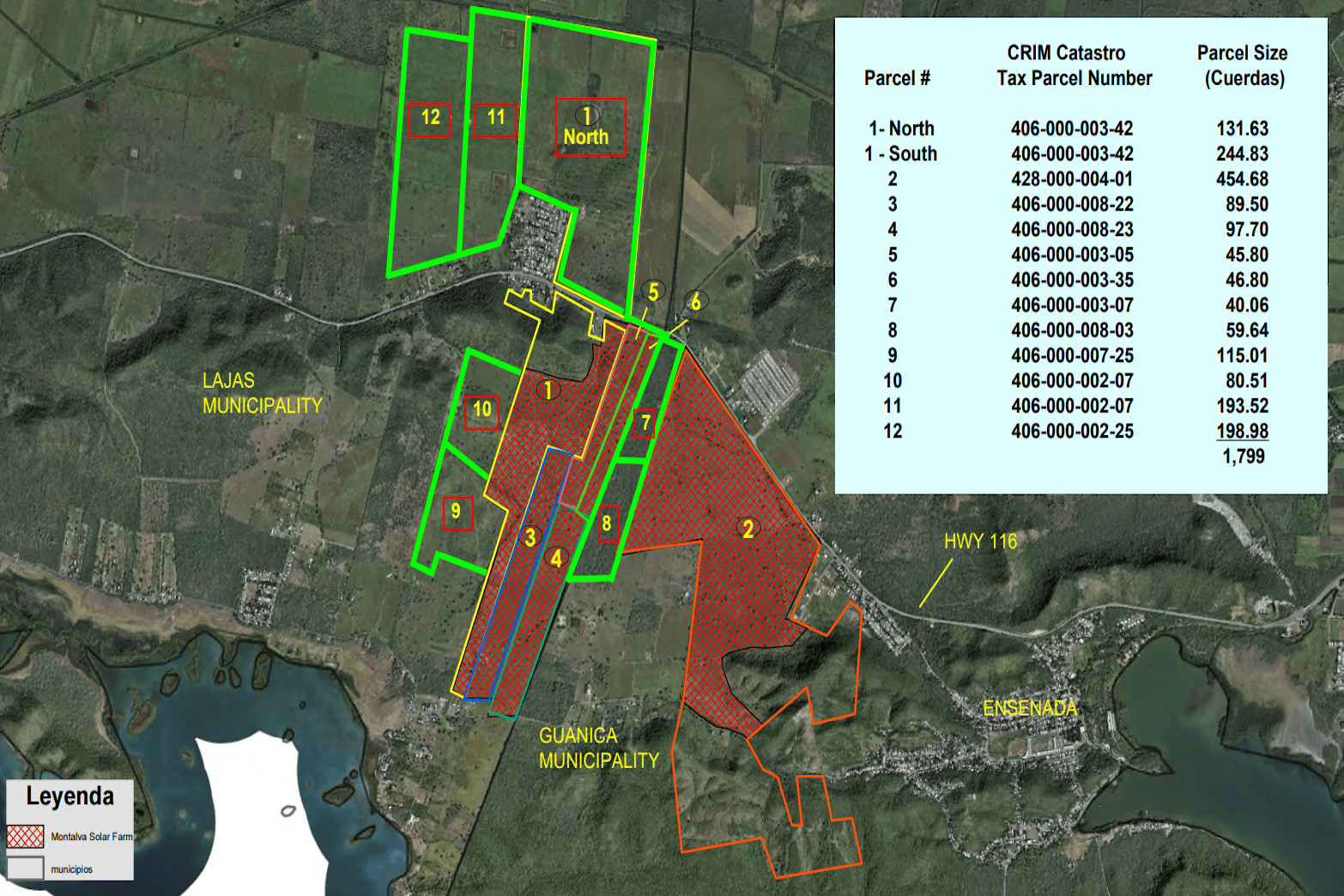

Property Name: MONTALVA

Our Montalva property is a 1,747 acre large utility-scale solar and battery storage farm build with an initial size of

80 MWac or 160 MWdc,(which is about 320,000 solar panels) located in the very sunny and dry

southwestern coastal area of Puerto Rico.

Today’s Weather

Site Map

Location: Guánica, Puerto Rico; 17.975660, -66.961092.

Focus: Renewable green energy for the people of Puerto Rico.

Size: 320 MWac / 160 MWdc, sufficient to provide renewable energy to 38,000 homes and the largest solar facility in the Caribbean region. Total property size: 1,747 acres (1,799 cuerdas or 707 hectares).

Competitive Thesis

Competitive Landscape: Puerto Rico adopted a Renewable Portfolio Standard on July 19, 2010 with the passing of Act No. 82. The act established goals to reach 12% of renewable energy by 2015, 15% by 2020, and 20% by 2035. There’s a political consensus that the current level of 3% renewables is well behind targets. With UV levels between 8-11 throughout the year, Puerto Rico is well-positioned to make use of its solar power potential. Furthermore, with its current fossil fuel heavy blend of energy sources, the addition of solar capacity represents a needed reduction in emissions, but to date, little progress has been made.

Summary Economics: Present value of corporate free cash flow of USD 125.6 MM (CAD 169.4 MM).

Environmental Impact: The Montalva solar facility will reduce CO2 in the atmosphere by 179,000 metric tons annually, when compared to Puerto Rico’s current coal and oil-reliant electric utilities. This is the equivalent of 37,000 cars off the road, or planting 7,100,000 trees.

Status: Received full Settlement Agreement from PREPA to approve the contract on October 3rd, 2023. Greenbriar is currently working on refining the details with PREPA and will then seek approval with the FOMB.

Timeline and Asset Lifespan: 35-year operating life from target start of commissioning.

Partners in Site Development:

– EPC Contractor: CMEC.

– Other Vendors: CATL, MEPPI, Siemens, Trina Solar, Jinko Solar, Norton Rose Fulbright (legal).

Key Regulators:

Puerto Rico Energy Bureau (PREB), Financial Oversight and Management Board for Puerto Rico (FOMB), U.S. Department of Natural and Environmental Resources, U.S. Department of Fish and Wildlife, Puerto Rico Aqueduct and Sewer Authority (PRASA), Municipality of Guánica and Lajas, OGDE, EPA, EQB.

Risks and Mitigants

– Technological: The Tier 1 PV solar panels and storage to be installed will be at the high end of industry standards for output, reliability, and durability. Panels rate at 500 Watts DC at 1,000 Volts and 21% efficiency, with battery storage, multiple sun-tracking methods, state-of-the-art SCADA facility control system, and optimized to 2:1 DC to AC ratio for the most efficient/complete solar capture.

– Changing Governmental Support, potentially in the form of price renegotiation. The island is well behind the renewable targets outlined above (currently at 3% versus a target of >15%). Both political parties support more renewables, and there is a scarcity of projects underway. Montalva is the only project actively planned. Montalva’s offtake agreement provides energy at less than 50% of the island’s current retail electricity cost. Finally, recent regulatory approvals for Montalva provide for higher electricity prices than are currently modeled and represented here.

– Weather/Hurricane: The facility is covered by insurance.

Economic Details and Valuation

Third-party source for forecasted asset economics – Report by Solutions Economics, authored by Professor Leonardo Giacchino who has 25 years of experience, on over 100 projects in 30 countries, conducting due diligence and feasibility studies for power plants, utilities, and pipelines. His bio can be found here.

Total Greenbriar Asset Revenue: USD 775.0 MM.

Discounted Greenbriar’s Present Value of Free Cash Flow: USD 125.6 MM (using a 6% rate for consistency with other assets, versus Solutions Economics’ rate of 4.87% which would drive a USD 139.7 PV of free cash flow).